Octa is our 3rd ranked forex broker for Nigerian traders. They have low spreads that are variable, no commissions or swap, local commission free bank deposit/withdrawal options, negative balance protection & MT4, MT5, OctaTrader platforms. Read our full OctaFX Review to find if they are good fit for you.

Octa (formerly OctaFX) is a forex & CFD broker that was founded in 2011, and they are a popular broker in African markets. They also accept Nigerian clients, and they also offer local bank transfer payment option for traders in Nigeria.

Octa offers multiple trading instruments including 35 currency pairs (52 on MT5), CFDs on indices & metals (gold & silver), energies, stocks (on MT5) as well as 30+ cryptocurrencies. They do offer fast order execution, quick deposit/withdrawals, low spreads (no commissions) and good customer support.

We signed up with their platform for this review. Read our detailed Octa review to find out what they are good at, and where they can improve.

First, right below is a quick summary of Octa’s pros & cons for you.

Octa Nigeria Pros

Octa Nigeria Cons

Table of Contents

| Broker Name | Octa Nigeria |

| Year Founded | 2011 |

| Website | www.octafx.com |

| Address | 1st Floor, Meridian Place, Choc Estate, Castries, Saint Lucia. |

| Octa (OctaFX) Minimum Deposit | $20 for traders in Nigeria (₦30,000 approx) |

| Maximum Leverage | 1:1000 |

| Regulation | MISA, FSCA, CySEC |

| Trading Instruments | 35 Currency Pairs, CFDs on 30 Cryptos, 24 Commodities, 3 Energies, 10 Indices. (plus 150 stocks as CFDs on MT5) |

| Trading Platforms | OctaTrader, MT4, MT5 |

| Octa Bonus | 50% deposit bonus on all deposits (for new traders & existing traders) |

Traders based in Nigeria are registered under OctaFX.com, which is their global website.

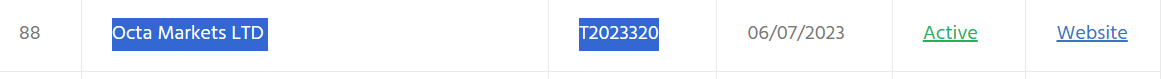

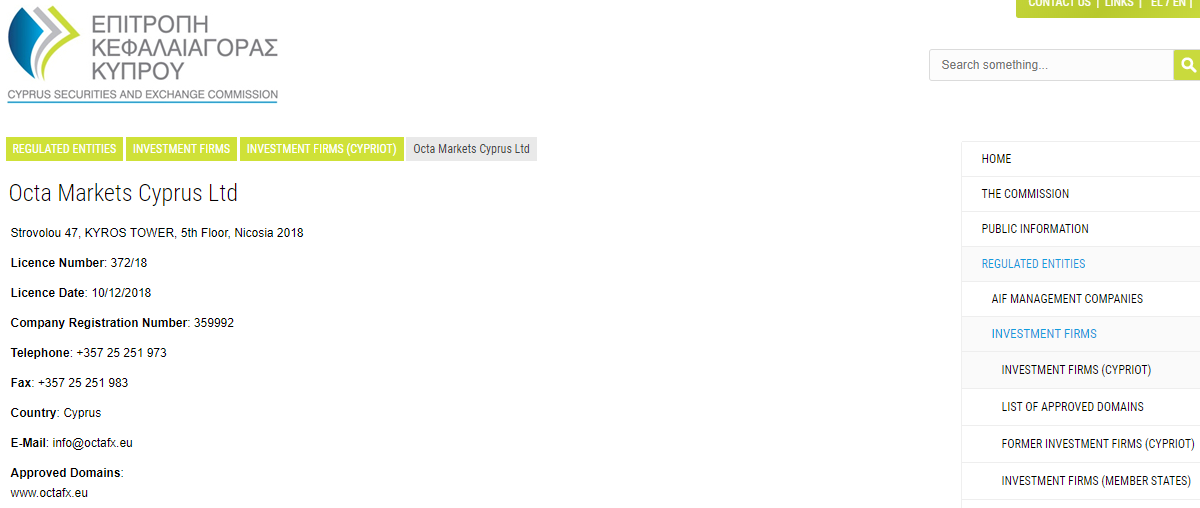

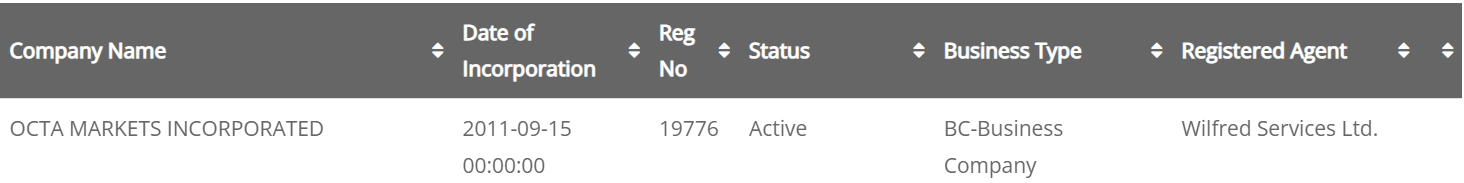

Octa is regulated with the following regulators:

Overall, Octa is not regulated with any Top-tier regulator, and they are regulated with MISA, FSCA & CySEC only. And they have been in business since 2011, and we did not find complaints regarding withdrawal issues. Moreover, if you reside in the EU and access Octa, you will be legally covered under CySEC regulatory.

Octa has segregation of their client’s funds and negative balance protection. So, we consider them to be relatively safe but a moderate risk CFD broker.

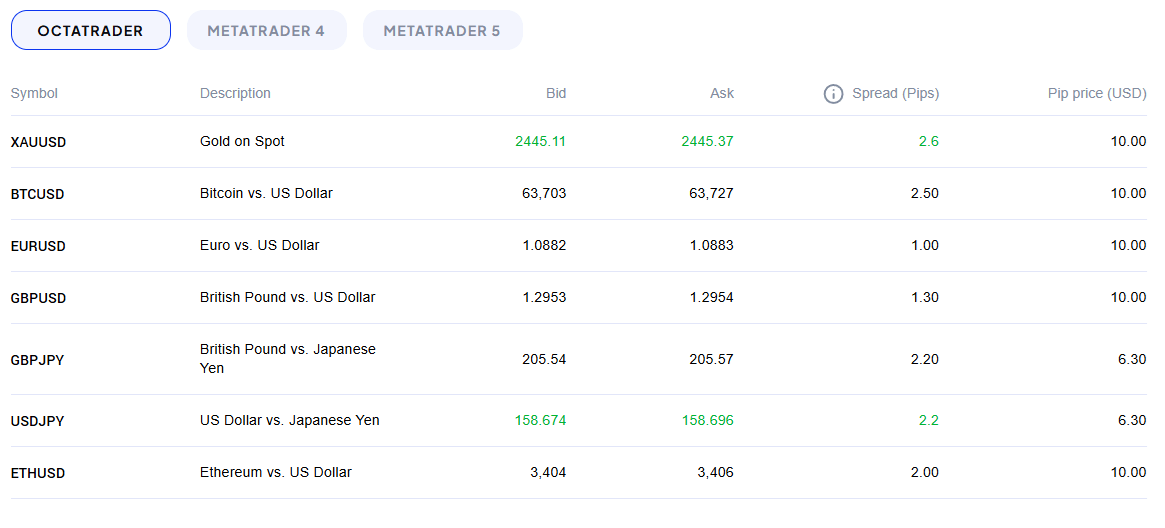

We reviewed Octa for the trading fees offered by them and any hidden charges. We found their fees to be quite competitive compared to other forex brokers in Nigeria.

There is no commission charged by account, you will only pay the variable spreads. You also don’t pay any other extra fees (no deposit charges, no withdrawal charges), this is unlike some other brokers who charge you for withdrawals.

Below are the breakdown of all the trading & non-trading fees of Octa:

With a leverage of 1:40 and no commission, Octa traders can trade 150 CFDs on stocks from 16 stock exchanges.

10 different indices are offered for trading at Octa. On indices, the leverage is up to 1:40.

Octa offers trading in five different commodities: WTI crude, Brent crude, natural gas, gold, and silver. Leverage on commodities is up to 1:200.

Over 30 cryptocurrency pairs are accessible for trading around-the-clock. These include Litecoin, Bitcoin, Ethereum, and Ripple, among others. Cryptocurrency leverage is 1:200.

Octa offers 3 Live trading accounts & also a Free demo account. We compared the features of their accounts with other brokers. Here is what we found.

Octa offers a Free demo account to all clients, using which you can practice and familiarise themselves with their platform and Forex trading. Once you have gained enough experience, you can open live trading account to start a Forex trading.

The following 3 Live account types are available at Octa for Nigerian traders:

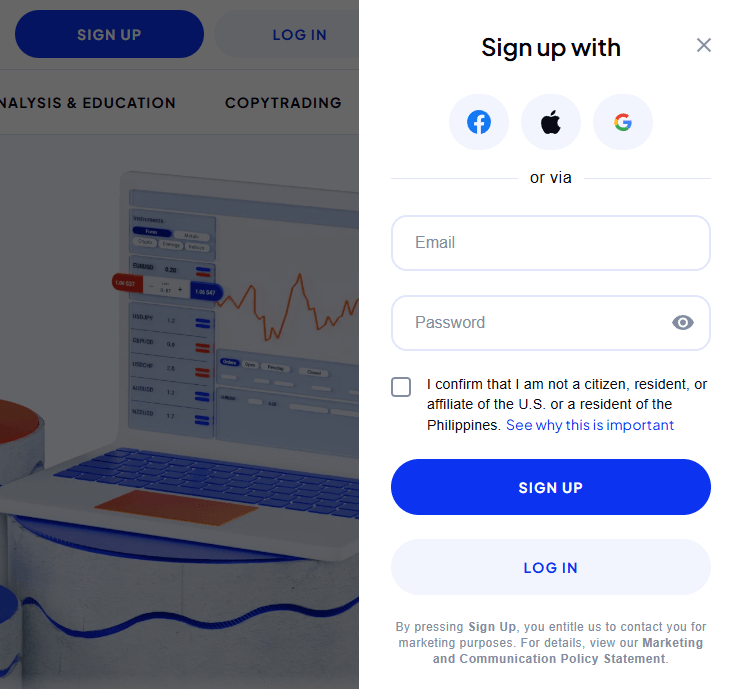

Opening an account with Octa is very simple. You simply need to follow the below steps one by one to complete the registration with them.

Step 1) First of all open the home page of Octa and click on the Open Account button at the top the home page.

Step 2) Now you need to open the personal information like name and email which is necessary to open the account. You can also signup using your Facebook or Gmail account.

Step 3) After entering all the required details, you need to click on Sign Up Account button at the bottom of the same pop up as shown in the below screenshot.

Step 4) Once done with the step 3, you need to verify the authorization by clicking on the link sent to your email for verification.

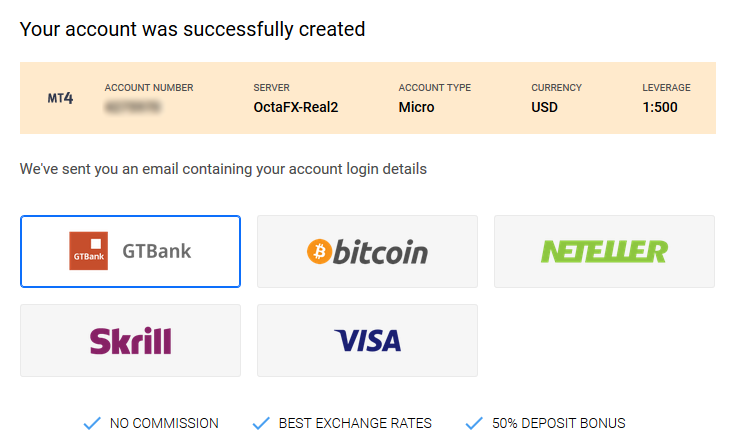

Step 5) Now you will be redirected to a page where you need to enter your details under “Provide your Details” section. Note that you will be required to enter your details like your Full Name & Address.

Step 6) In next page you need to select account type and other platform like base currency, leverage, etc.

Step 7) At last you need to make the deposit by clicking on the Deposit button on the right side of the screen. You can deposit the funds to start trading.

Congratulations! Your account has been created and funds will be reflected to your account as per the method you have used. You can now start trading as per your strategies.

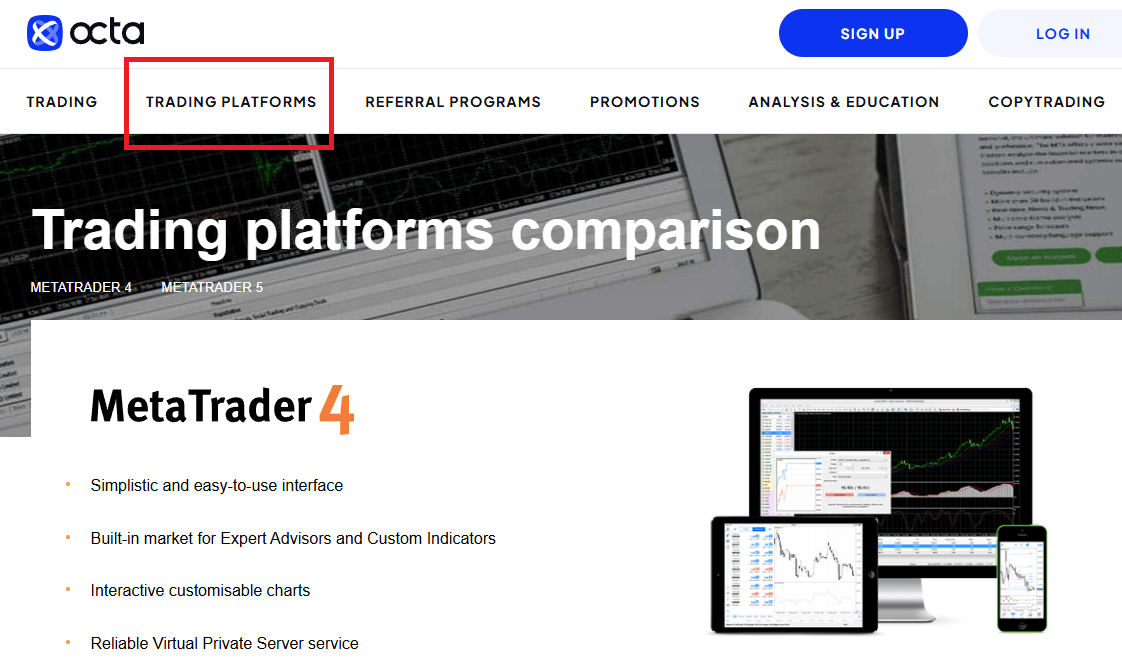

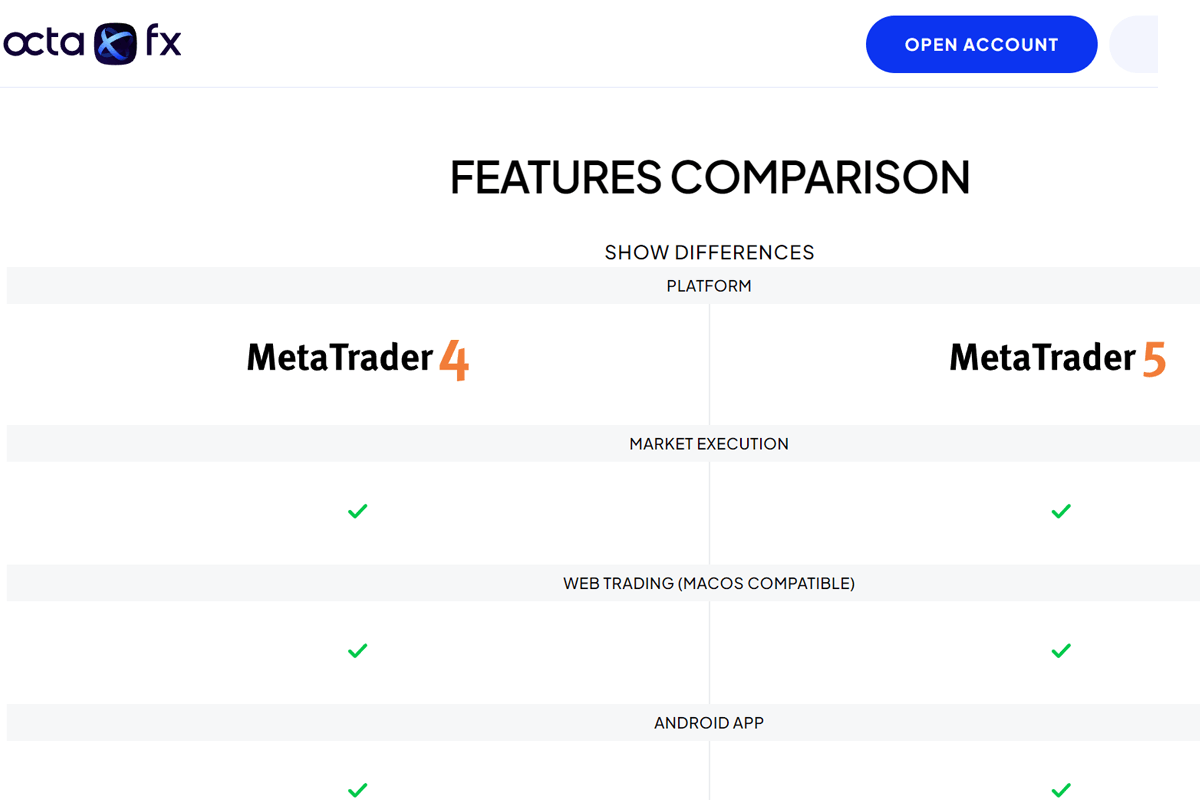

Octa has a wide range of platforms, depending on your account type with them (which you have to choose during account opening). They are one of the few brokers to offer both Metatrader versions (MT4 & MT5). And they also have their proprietary OctaTrader platform.

Here are the trading platforms available at OctaFX:

The MT4 trading platform’s primary features include:

More than 30 trading indicators built-in to aid traders, Functionality of an expert advisor, It supports 3 chart kinds, 9 periods, and 4 pending order types, Micro lots to aid newcomers and novice traders, Enables hedging (depends on the online broker policy too).

With MT5, you have all the functionality of MT4 plus:

37 graphical items, 12 periods, 38 built-in indicators, 6 pending order kinds, and guaranteed data backup for trading history information.

There are versions of MT4 and MT5 for Windows, Android, iOS, and web browsers. OctaTrader is their own app.

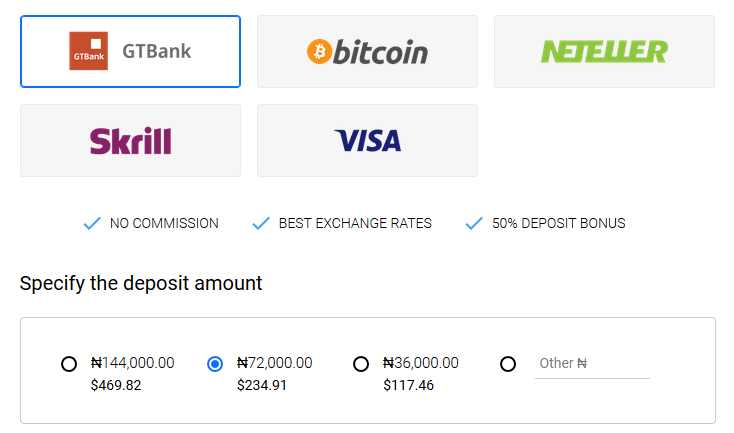

Octa does not add any extra fees/charges on deposit and withdrawal, which means they offer commission free payment methods. So you will get full amount of your funding & withdrawals.

Octa claims that the withdrawal process usually take 1-3 hours maximum for most methods, we did not test all methods. Some of their wallet methods have instant funding & withdrawal.

We have listed below all the payment methods using which you are make the deposit and withdrawal with them.

The deposit & withdrawal options at Octa are good for traders in Nigeria as local traders can also use local payment options like bank transfer.

| Method | Minimum Deposit | Minimum Withdrawal |

|---|---|---|

| Bitcoin | 0.00037000 BTC | 0.00009000 BTC |

| Skrill | 50.00 USD | 5 USD |

| Neteller | 50.00 USD | 5 USD |

| Visa | 25 USD/EUR | 20 USD |

| Perfect Money | 25 USD | 5 USD |

| Instant bank transfer | ~25 USD (in local currency) | N/A |

| Local Banks | ~25 USD (in local currency) | N/A |

| E-wallets | ~25 USD (in local currency) | N/А |

| Mastercard | 50.00 EUR | N/A |

| Tether TRC-20 | 50.00000000 USDT | 20.00000000 USDT |

| Tether ERC-20 | 50.00000000 USDT | 20.00000000 USDT |

| Dogecoin | 230.00000000 DOGE | 75.00000000 DOGE |

| Litecoin | 0.30000000 LTC | 0.11000000 LTC |

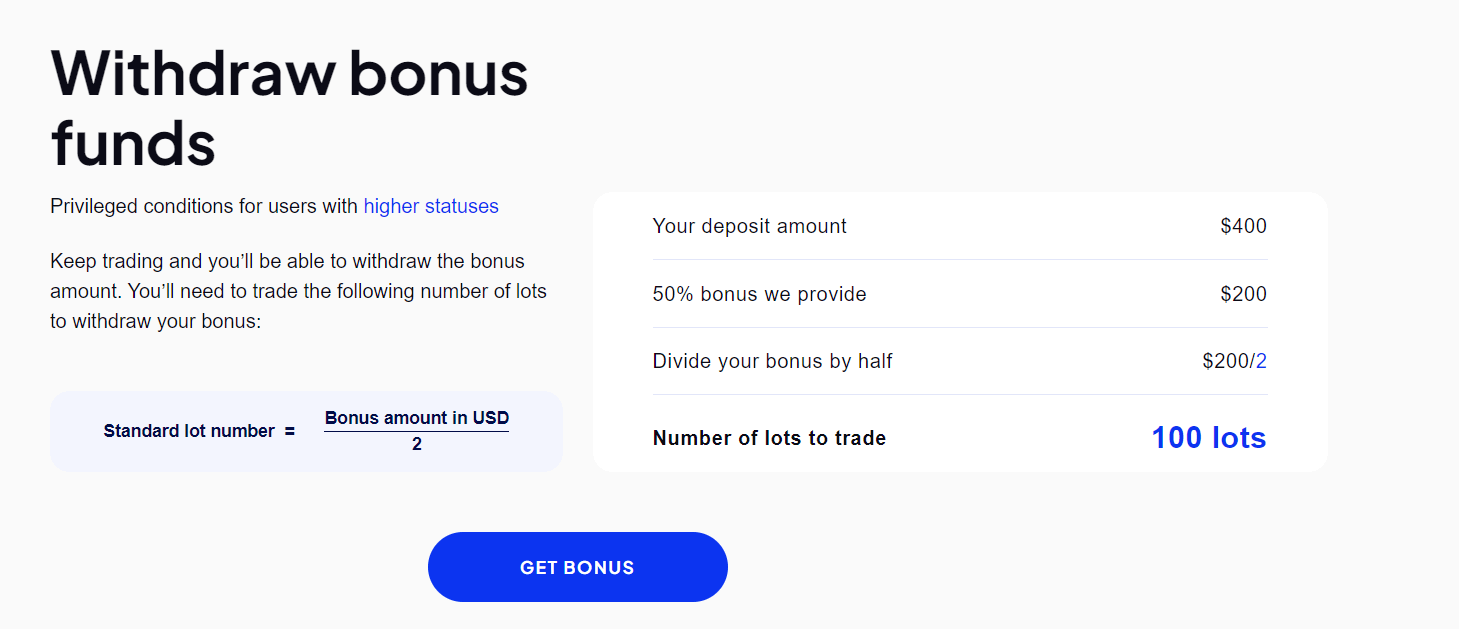

Octa have an ongoing bonus offer, which is available for Nigerian traders as well. Below are the available offers at Octa.

50% Deposit Bonus: Octa has a 50% deposit bonus right now, under which you can deposit any amount with them and you will get 50% bonus on it. You will be eligible to get 50% bonus on all your deposits. Also, the the bonus can be withdrawn provided a few trading conditions are met i.e. the number of lots traded.

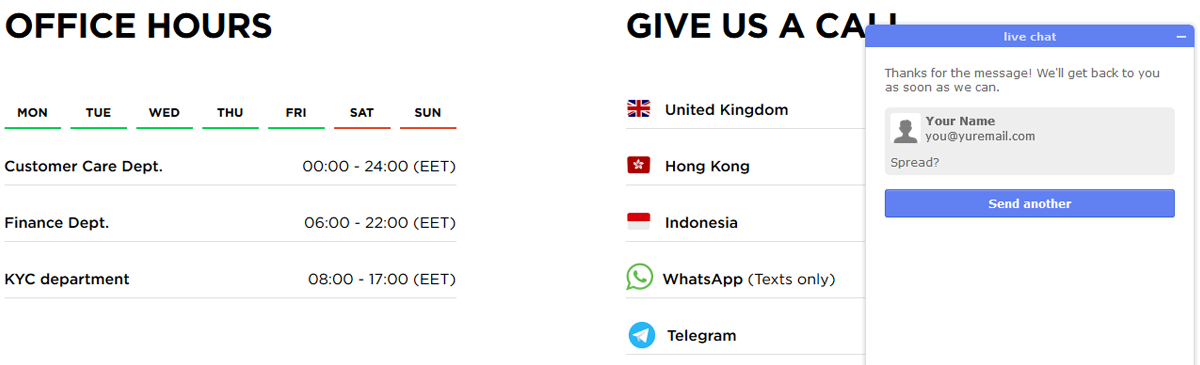

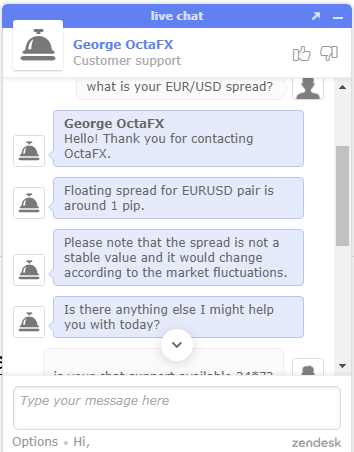

Overall, Octa’s customer support is reliable & active. They have a live chat that is available on weekdays, and they have 24*7 support available via email.

Overall the support at Octa is good, other than the fact that they don’t have local phone number in Nigeria. But we found their live chat & email support to be responsive in answering our questions.

Yes, you can trade Gold CFDs through Octa’s platform or their app. You can find the XAU/USD symbol on their app, and open the chart to place the order on Gold.

They don’t have any Swap charges for XAU/USD under MT4 account. But their variable spread is moderate at around 2. For example, if you are trading 1 lot of Gold on Octa with price at 1800, you will be charge $2 spread. If you are trading 100 lots, then you will pay $20 in fees on single trade.

You should not use Octa’s CFDs for investing in Gold. The CFDs are meant for trading by professional traders, and any holding costs can lead to losses for investors.

If you want to invest in Gold, you should consider local investing options from your bank or an exchange listed Gold EFT.

Forex Trading is currently not regulated in Nigeria, all forex brokers including Octa are registering the clients under offshore jurisdiction. It is at your own risk when you trade forex through any forex broker, because they are not licensed in Nigeria.

But Octa is licensed under CySEC & FSCA, which makes them somewhat low risk broker for Nigeria forex traders.

Yes, we recommend OctaFX (Octa) for Nigerian traders as they have low spread, good bonus & decent support.

The positive points about Octa are their low spread on major currency pairs, and their good customer support. Also they offer multiple trading platforms including the latest MT5, as well as the old MT4 version. So they it should fit both new and experienced traders.

Moreover, they also offer local bank deposit and withdrawal in GT Bank to Nigerian clients, which is a very good option and make them one of the few brokers that offer it.

On the downside, their trading instruments are limited as they only offer upto 50 currency pairs & other CFDs. Also, they could do better in terms of getting regulated with more regulators.

But overall, Octa is a good broker if you are looking for low-cost forex trading, without commissions.

Octa is registered with SVGFSA, which is an offshore regulation. They are not authorized by any Tier-1 regulation like FCA, ASIC etc. But they are a popular CFD broker that has been operating for a few years. So, they are considered a moderate risk forex broker.

The minimum deposit at Octa is $25. They offer 2 account types, and both have $100 minimum deposit.

No Octa does not offer NGN base currency trading accounts. They only offer USD as the account base currency. But you can deposit & withdraw in Naira via local bank account.

Octa does not charge any commission with any of their 3 trading accounts. They only charge spreads per trade. The exact spreads are variable & depend on the instrument which you are trading. For example, for EUR/USD, their spreads can be as low as 0.8 pips.

You can trade forex & CFDs on Octa by opening your trading account with them. You can use their mobile app or the MetaTrader platform to trade. They also offer OctaTrader app.

Yes, you can open multiple ‘trading’ accounts from your Octa Account. These are trading accounts, not separate Octa accounts, meaning you can have one OctaTrader account, another MT4 account for example. But this does not mean that you can open multiple Octa accounts, this only means that under your 1 Octa account you can have multiple accounts for trading.

The benefit of having multiple accounts is that you can use these for different trading strategies. For example, you can use one account to only swing trade, and another account for intraday trading. Or you can have different accounts in different base currencies.

Octa is not regulated in Nigeria, so you should note that you are trading with them at your own risk without any regulatory protection. They are a foreign forex broker, regulated by only 1 Tier-2 regulation i.e. CySEC. This makes them a moderate risk broker for Nigerian traders.

Octa has various deposit & withdrawal methods on their platform including Local Bank transfer in Naira. There is no extra fees on funding or withdrawals. Withdrawals via Bank transfer can generally take a few hours at Octa.

"Do you have experience with Octa (OctaFX)? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow Nigerian Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Comments are closed.

I am currently starting my trading activity with OctaFX whilst studying and learning its procedure. I have even deposited some amount when I realized that it has a good prospect in Nigeria.

5