Avatrade is our #6 rank forex broker for Nigerians. They are a fixed spread market maker broker, and their fees is competitive. But should you choose them or not? Read our honest Avatrade review to know more!

Avatrade is an Ireland-based fixed spread Forex broker that also accepts traders from Nigeria. They were founded in 2006 & are one of the leading brokers in the world. They have over 200,000 registered traders globally.

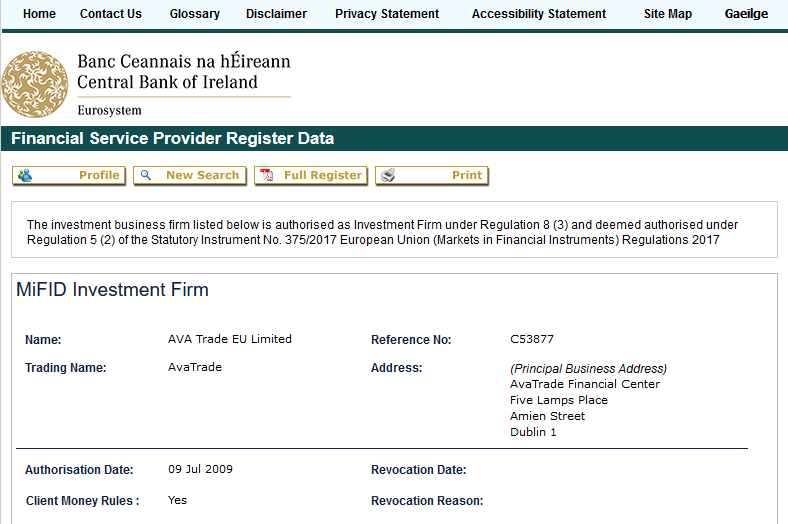

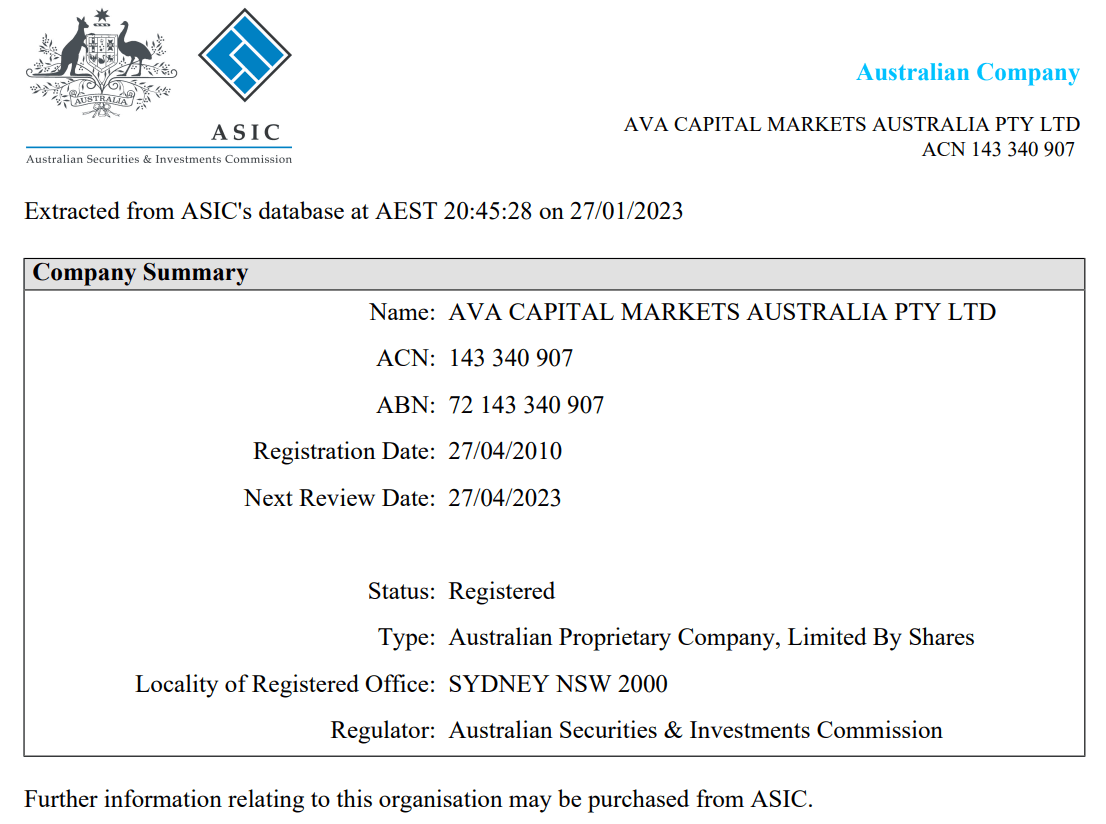

Avatrade is well regulated i.e. with the Central Bank of Ireland, FSCA (South Africa) & ASIC (Australia), so trading with them is safe. They are a fixed spread broker, so the fees they charge are fixed for every trade, and we have found them to be very competitive in terms of their fees.

We looked into Avatrade Nigeria’s regulations, their trading (and non-trading) fees, platforms, deposit/withdrawals, support & many other factors for this review.

Want to know if Avatrade is really good (or bad) for you? Let’s look into our detailed check of all the factors for this broker.

Avatrade Pros

Avatrade Cons

Table of Contents

| Broker Name | Avatrade Nigeria |

| Year Founded | 2006 |

| Website | www.avatrade.ng |

| Nigerian Address | Five Lamps Place Amiens Street, Dublin 1 Ireland |

| Avatrade Minimum Deposit | $100 |

| Maximum Leverage | 1:400 |

| Regulation | Bank of Ireland, FSCA (South Africa), ASIC (Australia) |

| Trading Instruments | Forex, CFDs on Crypto Currencies, Metals, Indices, Shares, Energies, Commodities, Bonds |

| Trading Platforms | Avatrade MT4, MT5 for PC, Mac, Web, Android, and AvatradeGo app. |

| Avatrade Bonus | 20% deposit bonus for new clients (minimum $1000 deposit required) |

Avatrade is a regulated broker that has licenses with multiple top-tier regulators in Europe, Australia & South Africa.

They are regulated with following regulatory authorities:

Further, Avatrade is also regulated in Japan as well as many other countries. But on a bad note, they are not yet regulated with FCA (UK), which is a top-tier regulator.

Overall, we consider it safe for Nigerians to trade forex with Avatrade as they are well regulated & a reputed broker.

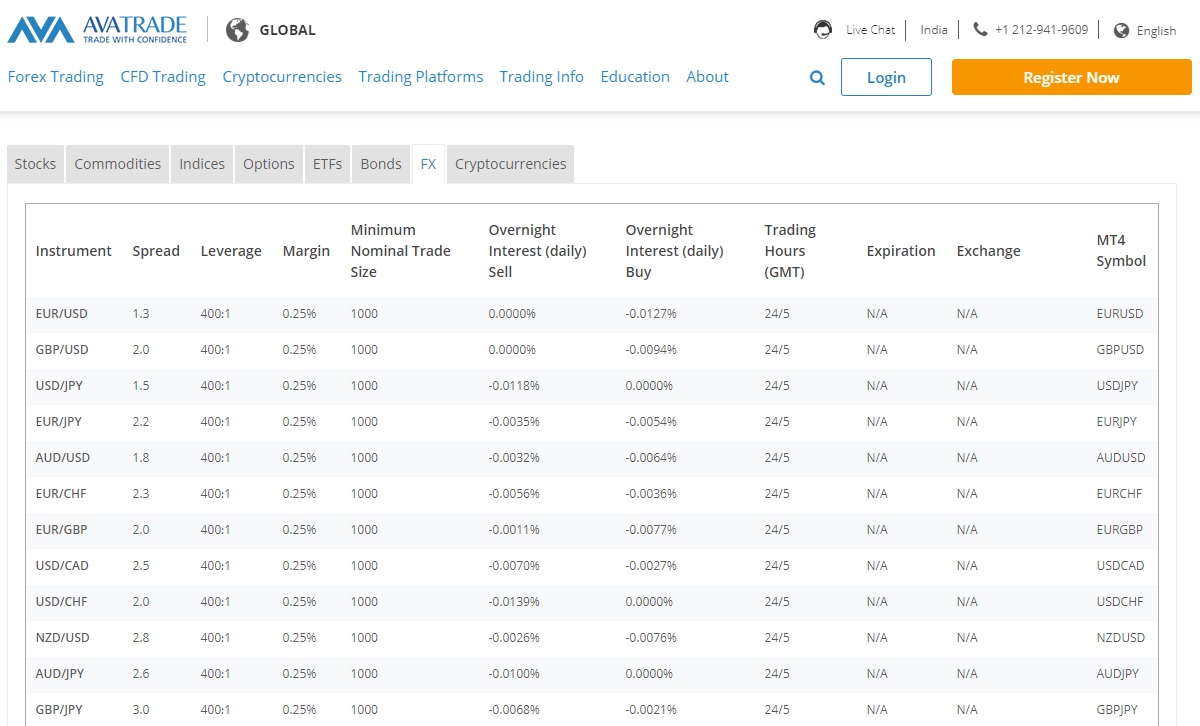

Avatrade is a fixed spread market maker broker, with a zero commissions account. Hence the trading fees with them are fixed per trade (only the spread) depending on your currency pair or trading instrument.

Here’s a breakdown of the fees at Avatrade

Based on our research, this spread is quite low, and it is lower than FXTM’s spread but higher than the spread offered by Hotforex Zero Account, XM Ultra-Low Account & Exness.

In short, Avatrade has very low spread & no other commissions at all. We like their low fees per trade, and only few other brokers i.e. Hotforex & Exness charge similar or bit lower fees then Avatrade.

Avatrade offers demo accounts & 1 live account type. Below are the features & the account types offered by them.

Avatrade offers demo accounts, but the limitation is that they are active only for 21 days. You will have to contact their customer support if you need to extend the demo for more days.

Avatrade is very straightforward & simple in terms of their live trading account types. They offer a 1 single Live account with all of their features. There are no choices or account options.

The following features come with Live Accounts at Avatrade:

But all in all, their execution is quick & we found no complaints related to their order execution.

Overall, we have found Avatrade’s accounts to be very simple & easy to understand. But no other account options like no ECN accounts, or lower spread accounts, may not be very good for some traders.

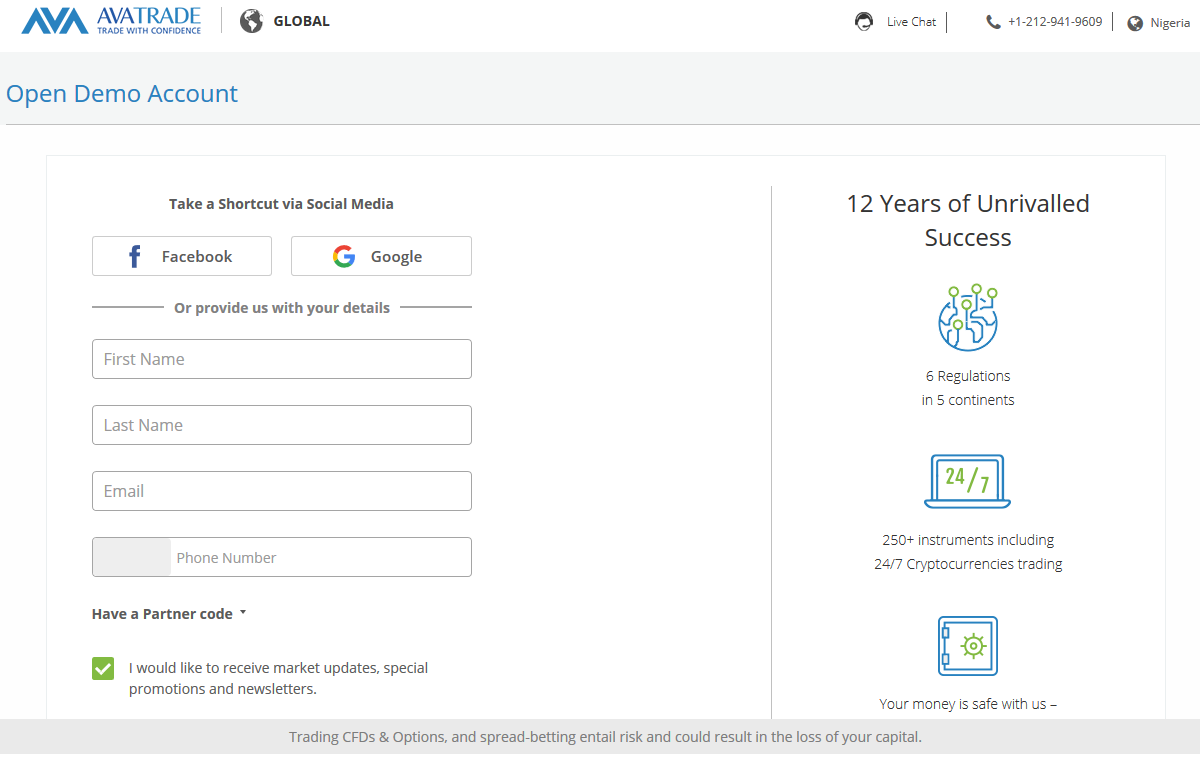

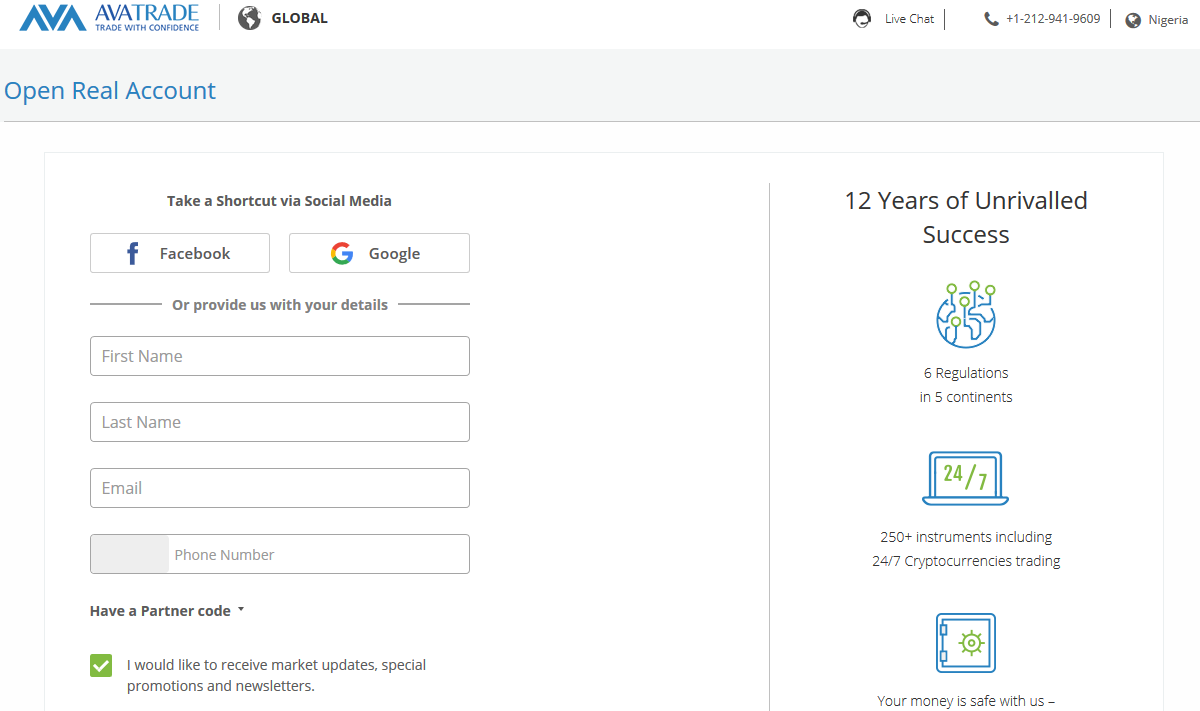

There are very simple steps that you need to follow to open an account with AvaTrade. Below is the list of steps that you can follow one by one to open an account with AvaTrade.

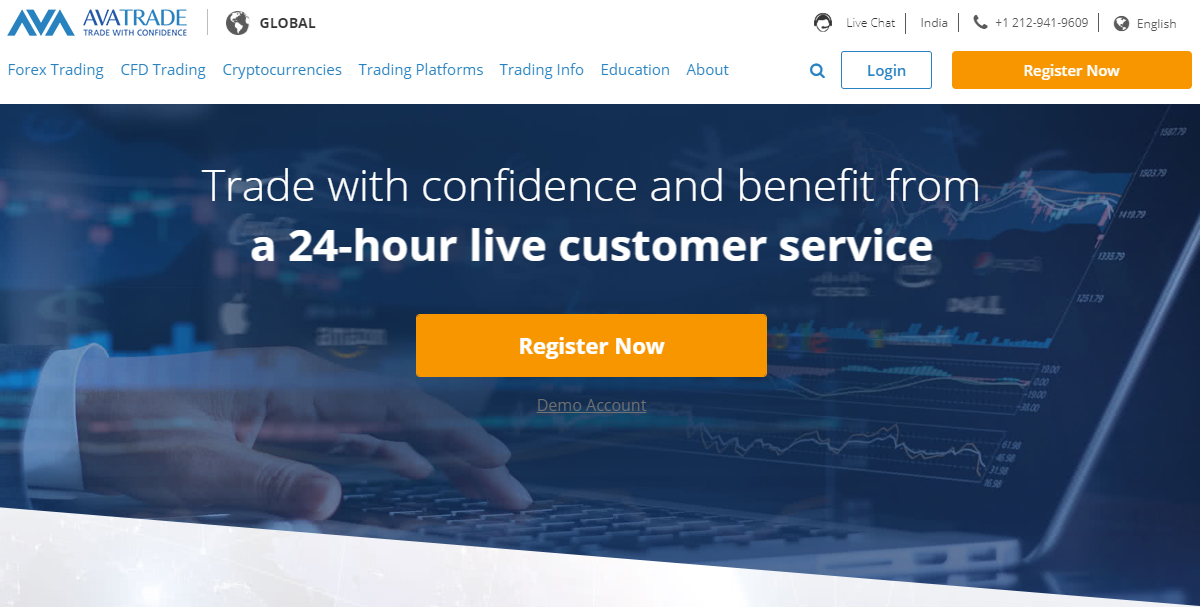

Step 1) First of all, you need to open the home page of the AvaTrade website and click on the Register Now button at the top right side of the screen.

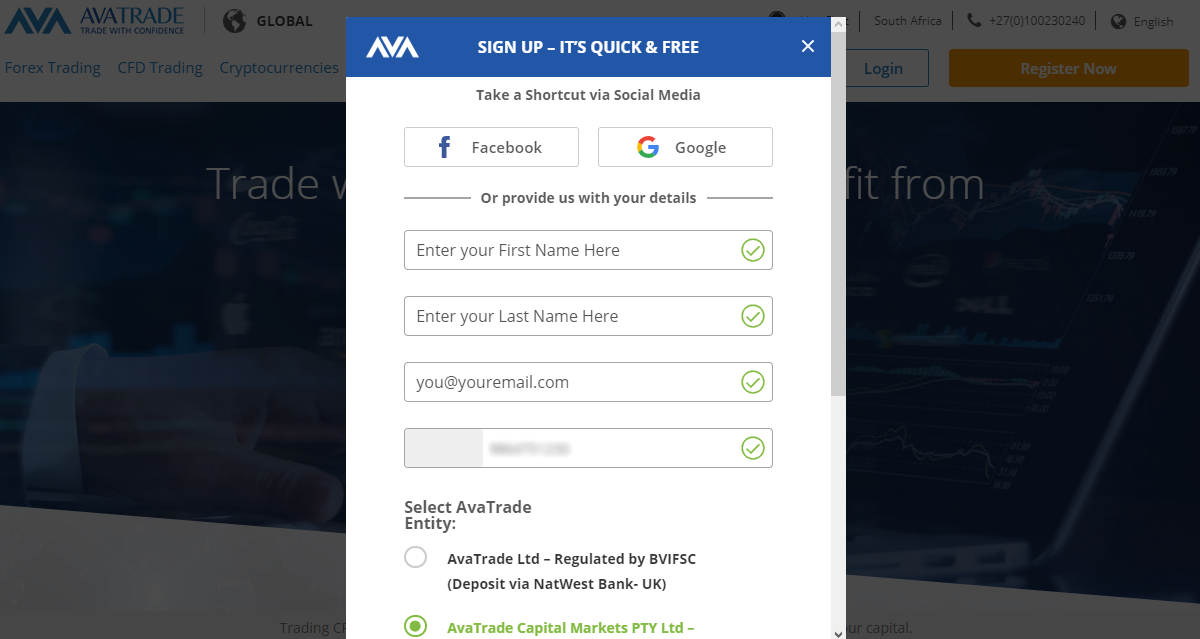

Step 2) After clicking on the Register now button, A SignUP pop-up will open where you need to enter your details. Or you can sign up using your Gmail or Facebook account.

Step 3) Now you will be redirected to a page where you need to enter your personal details to complete the registration process. You also need to select the Trading Platform and Base currency on the same page.

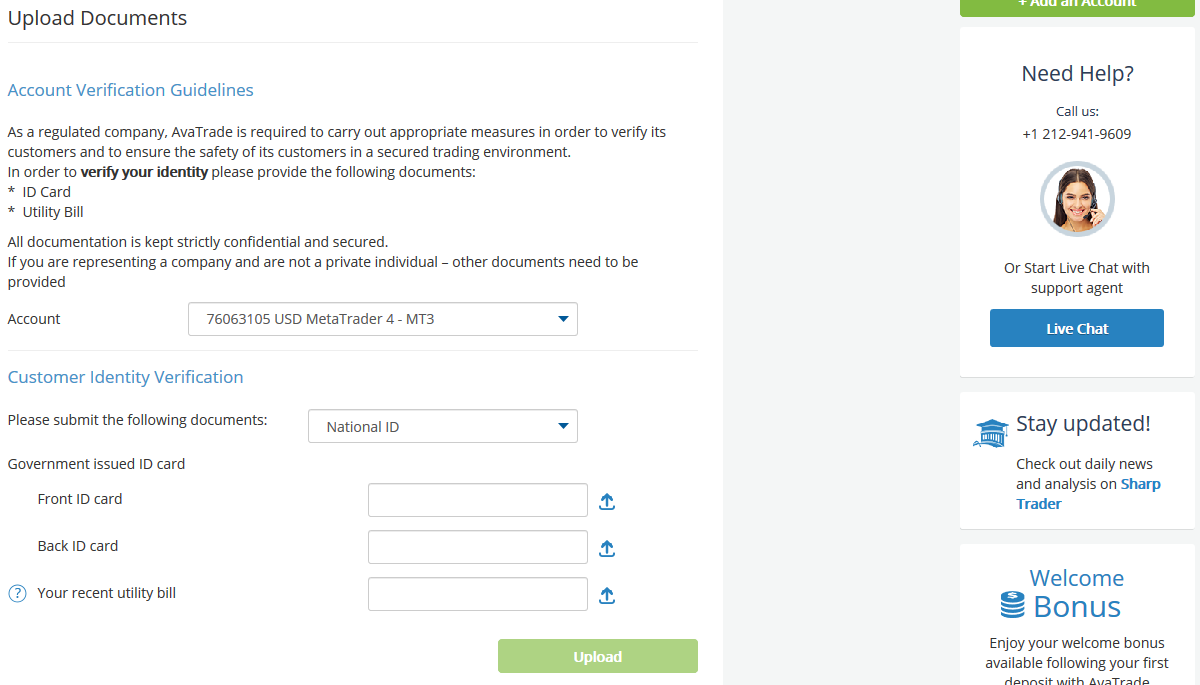

Step 4) Once done with the basic registration details, you need to verify your account. For that, you can upload your ID proof and Address proof.

Note: After submitting the documents, AvaTrade can take maximum 24 hours to check and verify your uploaded documents. Once your account has been verified, you will get a mail from them on your registered email.

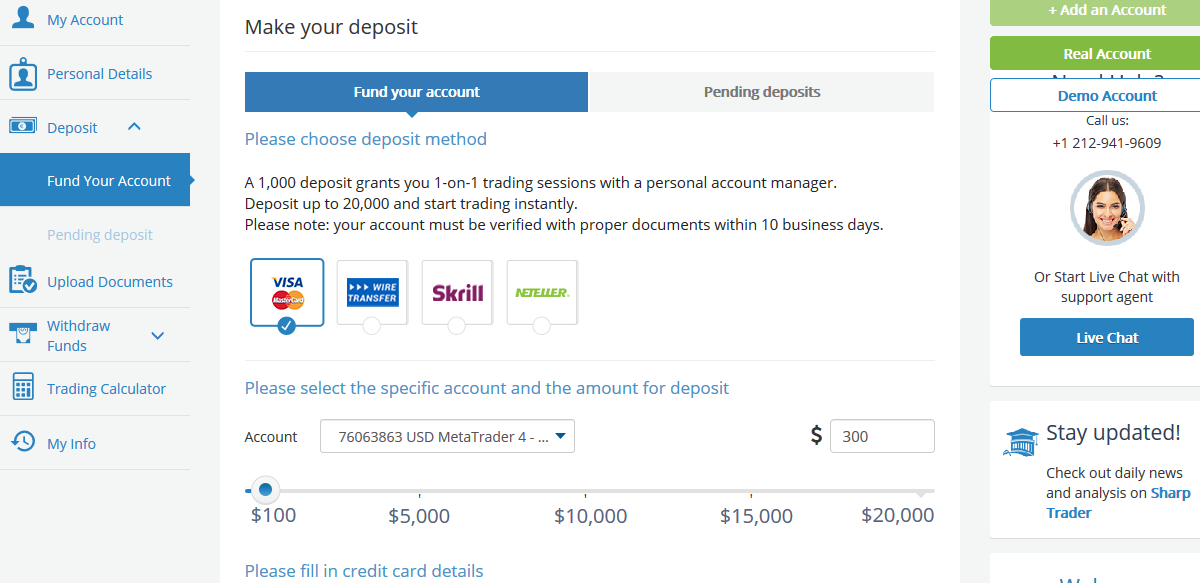

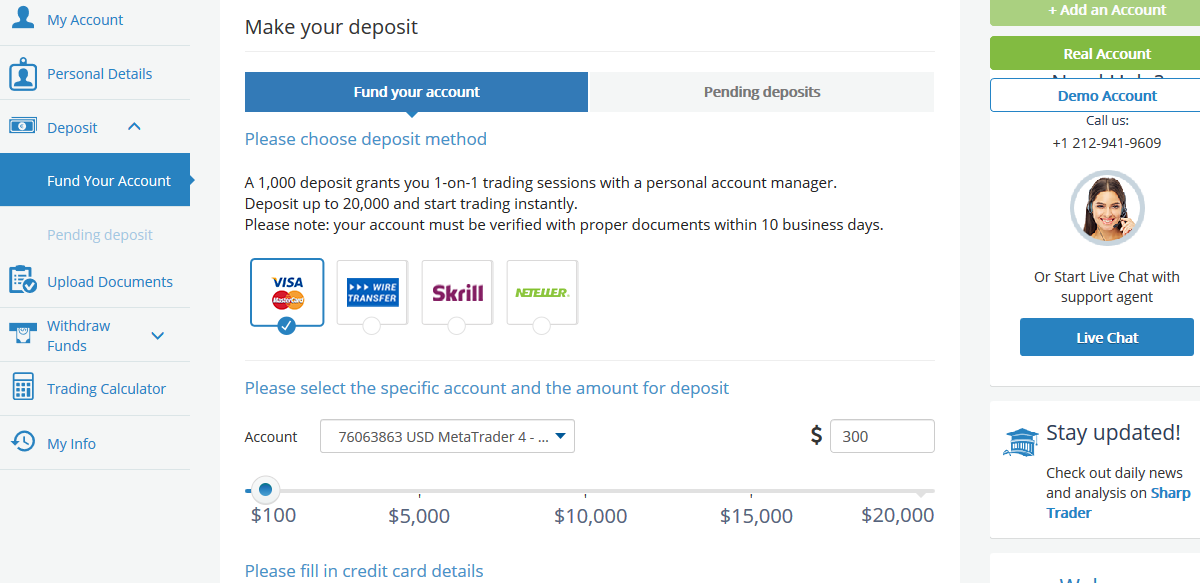

Step 5) At last you need to fund your account to start Trading. For that, you need to click on Fund your Account under the Deposit section as shown in the below screenshot.

Congradulations! Your account has been set up and you can now start trading with them. In case of any issue or query, you can contact them via Live Chat Support.

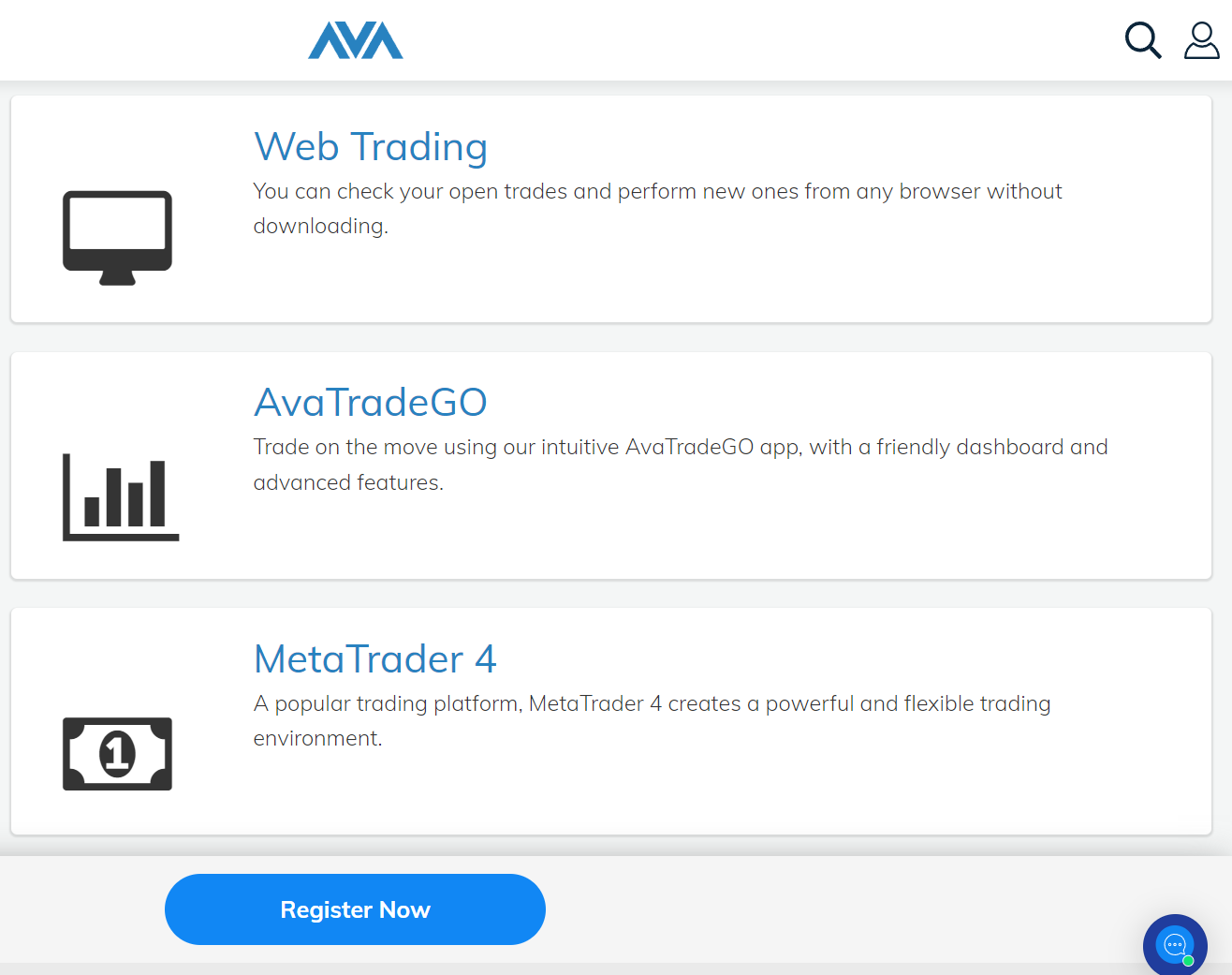

AvaTrade offers 3 platforms i.e. MetaTrader 4, MT5 for Mac, mobile, web, and PC, and another platform is their AvaTradego mobile app for Android & iPhone.

All Mobile app is fast & user-friendly. Overall in terms of platforms availability & choice, Avatrade is quite good.

Avatrade offers many deposit and withdrawal methods. The good part is that they charge zero fees on deposits & withdrawals. But on the negative side, some traders have complained about slow withdrawals & they also don’t have local bank transfer options in Nigeria.

Let’s check this out!

They offer 3 deposit methods i.e. cards, wire transfer, and Wallets. There is no local bank transfer option for Nigerians.

Here are the deposit methods available for Nigerian traders on Avatrade

The withdrawals at Avatrade are bit slower compared to other regulated brokers i.e XM, Hotforex, FXTM etc. Some users have complained that it took few weeks for them to receive the withdrawn funds.

Also note, you can get your first withdrawal via your funding source only. And your account must be verified before you can request a withdrawal, and any issue with any of your KYC documents can delay (or even cause cancellation) of your withdrawals.

According to our tests, Avatrade’s deposit and withdrawal methods for Nigerians are limited. And the time they take to process funding/withdraw requests is also slow.

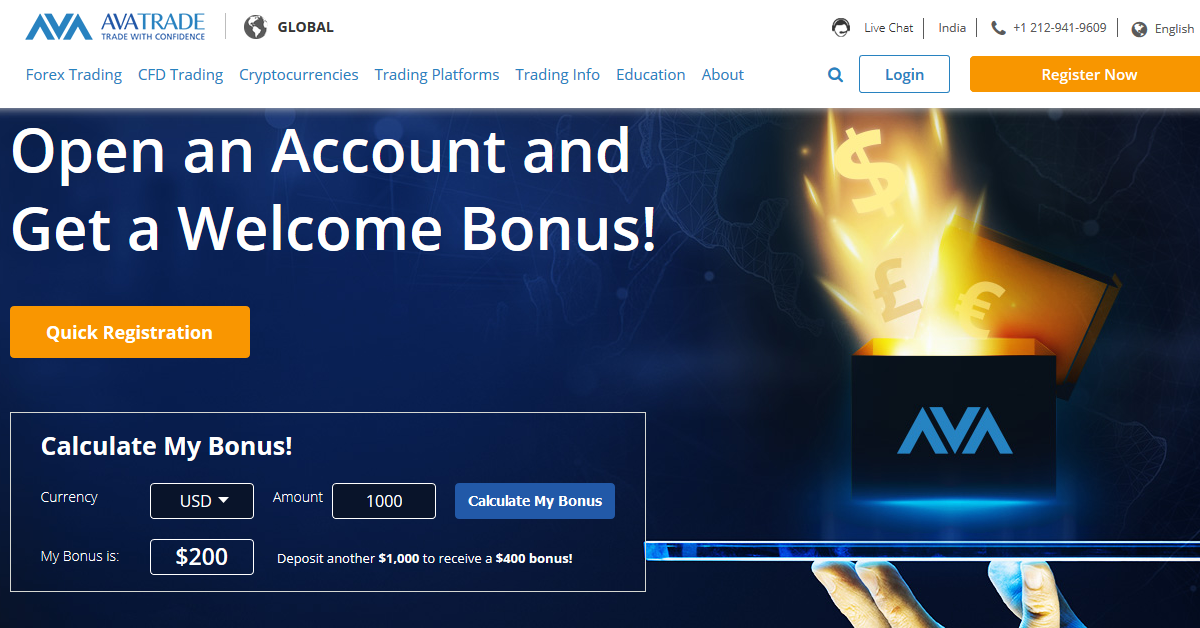

Avatrade does not offer any major bonus or loyalty programs for Nigerian traders. They only have a single welcome bonus promo, but that too has many limitations.

Below are the Avatrade bonus available currently:

The bonus offers at Avatrade are very limited. Other brokers like Hotforex offer 100% deposit bonus with only $250 deposit, whereas XM offers 50% deposit bonus to Nigerian traders, but Avatrade lacks in this department. Moreover, there is no loyalty program for existing traders, so we feel that they can improve on this.

Avatrade’s support is not the best. They offer local support options for Nigerian traders, but their support is not available for 24 hours in a week, it is only available during company’s business hours.

All their support methods i.e. chat, phone, and email are available from Monday till Friday 6:00 AM to 10 PM Nigerian time.

The following at the support methods available at Avatrade for Nigerians:

You can request for a callback via email, with the time at which you would like to receive the call.

Customer support at Avatrade lacks since it is not available 24/7. On the plus side, they have a local phone number for calling, but their chat and email support are slower & less knowledgeable than other brokers.

Yes, we recommend Avatrade if you are looking for a well regulated fixed spread broker that has local phone support in Nigeria.

Their fixed spread is competitive, and there is no commission. Plus they are regulated (in Ireland, South Africa & Australia) which means that your funds are safe with them.

But on the downside, their support is not that great. Also, some users have complained about slow withdrawals & delays.

Moreover, their 20% welcome bonus is not very friendly for Nigerians as it requires a very high deposit of at least $1000.

Overall, Avatrade is a safe broker for Nigerians, but there are some other better brokers that you can go for in terms of lower fees, better support, good bonus & faster withdrawals!

AvaTrade does accept clients from Nigeria but they don’t have any local office in Nigeria. Traders from Nigeria are registered under Ava Trade Markets Ltd. which is regulated by BVI FSC.

AvaTrade is regulated with top tier regulatory authorities in Australia (ASIC), South Africa (FSCA) etc. But traders from Nigeria are registered under offshore regulation. Still, AvaTrade is considered a low risk forex broker for traders in Nigeria..

The minimum deposit for trading with AvaTrade is $100. But the minimum deposit can be different for some payments methods as it depends upon the payment method that you will choose & your account’s base currency.

"Do you have experience with Avatrade Nigeria? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow Nigerian Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Submit Your Review